Information on the Facilities Sales Tax-Vote Nov 4!

Informational Flyer for Bement CUSD 5

1% Piatt County Facility Sales Tax to be on November 4 Ballot

“Shall a retailers’ occupation tax and a service occupation tax (commonly referred to as a “sales tax”) be imposed in The County of Piatt, Illinois, at a rate of 1% to be used exclusively for school facility purposes?”

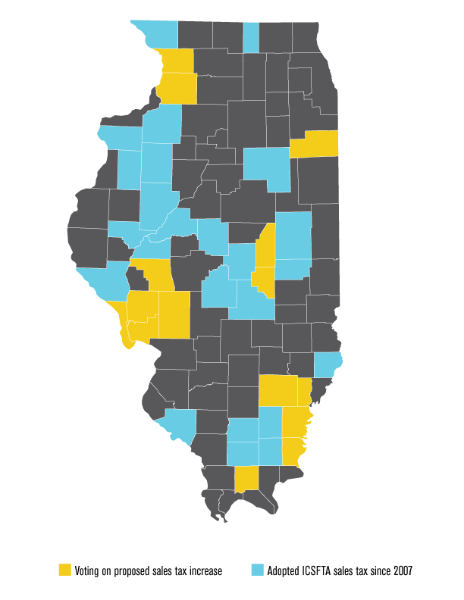

The Bement CUDS 5 Board of Education approved the Sales Tax question for the November 4 election. School districts in Cerro Gordo, Blue Ridge, Monticello and Atwood-Hammond-Arthur-Lovington also approved resolutions in support of the sales tax for school facilities. Approval of a sales tax for Piatt County School Facilities would generate an estimated $85,000 annually for Bement Schools and would be used for facilities upgrades and improvements. A presentation on the tax was made by Kevin Heid of Stifel Nicolas. Twenty-one counties in Illinois have implemented the tax including Macon, Champaign, Shelby, and Douglas Counties. A majority vote of the county would implement a 1% additional sales tax to be distributed to county school districts based on enrolled students. Dollars from the tax could only be used for facility improvements, maintenance, upgrades, new facilities, or paying off debt for these facilities. The dollars cannot be used for personnel, salaries, supplies, or instructional materials. The current tax rate in Piatt County is 6.25%, while Macon and Champaign Counties rates are over 9%. This additional 1% would still keep us as one of the lowest taxed counties in the area. Please check out the presentation that was made that explains the proposal.

The one-cent sales tax can be used to provide:

Energy efficient air conditioning for the high school and middle school

21st Century classrooms

Funding to replace windows and doors and keep them in good working order

Up-to-date technology

Other health/life safety projects

It is important to know what is NOT subject to this tax:

Unprepared food – groceries

Prescriptions and over-the-counter medications

Cars, Trucks, ATVs, Boats, RVs and Mobile Homes

Farm Equipment, Parts and Farm Inputs

Services are also not taxed

If it is currently not taxed, it will not be taxed.

Click on the link below to see a presentation on the Piatt County Facilities Tax.

Launch the media gallery 1 player

Launch the media gallery 1 player